Baxter (BAX) Q1 Earnings Beat Estimates, '24 EPS View Raised

Baxter International Inc. BAX reported first-quarter 2023 adjusted earnings per share (EPS) from continuing operations of 65 cents, which beat the Zacks Consensus Estimate of 61 cents by 6.6%. The bottom line improved 10.2% from the year-ago quarter’s level.

On a GAAP basis, the EPS from continuing operations was 7 cents, down 22% from the prior-year quarter’s level.

Continuing operations exclude Baxter's BioPharma Solutions business, which was divested during the third quarter of 2023.

Adjusted EPS, including discontinued operations during the first quarter, was 85 cents, down 3% year over year.

Revenue Details

Revenues from continued operation totaled $3.59 billion, up 2% on a reported basis and 3% at constant currency (cc). The figure beat the Zacks Consensus Estimate by 1.1%.

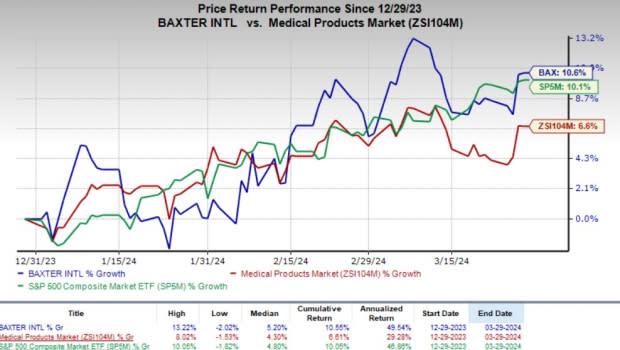

Despite better-than-expected results, shares of BAX were down 2.8% in pre-market trading. The company’s shares have risen 10.6% year to date compared with the industry’s growth of 6.6%. The broader S&P 500 Index has moved up 10.1% in the same period.

Image Source: Zacks Investment Research

Segmental Details

As part of its transformation plan announced in February 2023, Baxter established its new operating model, integrating its prior matrixed structure of nine businesses operating across three geographic regions into the aforementioned four verticalized global segments. The company started reporting under a new model since the third quarter of 2023.

Medical Products & Therapies

The segment includes Advanced Surgery and a new category, Infusion Therapies & Technologies. Total sales at this segment totaled $1.23 billion, up 6% year over year reportedly, as well as at cc. The growth reflects the benefit of positive demand and pricing across its two sub-segments.

Infusion Therapies and Technologies’ sales totaled $966 million, up 6% year over year reportedly, as well as at cc. Advanced Surgery category sales amounted to $263 million, up 7% year over year reportedly and 8% at cc.

Healthcare Systems and Technologies

The segment includes the Front Line Care category. It also includes the Patient Support Systems and Surgical Solutions categories, which are clubbed as Care & Connectivity Solutions. Total sales in this segment were $667 million, down 9% year over year reportedly as well as at cc. The decline was led by several factors, including softness in the U.S. primary care market and the phasing of certain orders to later in the year. The company expects this segment to return to growth in the second half of 2024 as it continues to address some operational challenges at present.

Front Line Care category sales totaled $265 million, down 12% year over year reportedly as well as at cc. Care & Connectivity Solutions category sales amounted to $402 million, down 6% year over year reportedly and 7% at cc.

Pharmaceuticals

The segment was reported as one of the product categories till the last quarter. Its report presently includes two product categories — Injectables & Anesthesia and Drug Compounding. Total sales during the fourth quarter were $578 million, up 11% year over year reportedly as well as at cc. The growth was primarily driven by new product launches and increased demand for Baxter's Drug Compounding services.

Injectables and Anesthesia category sales totaled $328 million, up 8% year over year reportedly as well as at cc. The Drug Compounding category sales amounted to $250 million, up 15% year over year reportedly as well as at cc.

Kidney Care

This segment includes BAX’s Renal Care category, which is now reported under the Chronic Therapies category. It also includes the Acute Therapies category. Total sales in this segment were $1.1 billion, up 3% year over year reportedly and 4% at cc.

Chronic Therapies category sales totaled $888 million, flat year over year reportedly but up 2% at cc. Acute Therapies category sales amounted to $214 million, up 14% year over year reportedly and 15% at cc.

Baxter plans to spin off this segment, which will trade as an independent, publicly traded company under the proposed tradename of Vantive. The spin-off is expected to be completed in the second half of 2024.

Other

Revenues in the segment amounted to $16 million, down 47% on a year-over-year basis as well as at cc.

Margin Analysis

Baxter reported an adjusted gross profit of $1.53 billion, up 6.6% year over year. As a percentage of revenues, the gross margin improved 170 basis points (bps) to 42.5%.

Selling, general and administrative expenses amounted to $1.03 billion, up 3.2% from the year-ago quarter’s figure. Research and development expenses totaled $176 million, up 7.3% on a year-over-year basis.

Adjusted operating income from continuing operations totaled $515 million, up 17.3% year over year. As a percentage of revenues, the operating margin improved 180 bps to 14.3%.

2024 Guidance

For second-quarter 2024, Baxter anticipates sales to grow approximately 1% on a reported basis and 2-3% at cc. The Zacks Consensus Estimate for the same is pegged at $3.76 billion, implying growth of 1.6% reportedly.

Adjusted EPS is expected between 65 cents and 67 cents. The Zacks Consensus Estimate for the same is pegged at 67 cents.

For full-year 2024, sales growth is expected to be nearly 2% on a reported basis and 2-3% at cc. The Zacks Consensus Estimate for the same is pegged at $15.1 billion, implying a year-over-year improvement of 1% reportedly. Adjusted EPS is projected in the band of $2.88-$2.98, up from the previous guidance of $2.85-$2.95. The Zacks Consensus Estimate for the same is pegged at $2.89 billion.

Baxter International Inc. Price, Consensus and EPS Surprise

Baxter International Inc. price-consensus-eps-surprise-chart | Baxter International Inc. Quote

Zacks Rank and Stocks to Consider

Currently, Baxter carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Align Technology, Inc. ALGN, Ecolab ECL and Boston Scientific Corporation BSX.

Align Technology, carrying a Zacks Rank of 2 (Buy) at present, reported first-quarter 2024 adjusted earnings per share (EPS) of $2.14, which beat the Zacks Consensus Estimate by 8.1%. Revenues of $997.4 million outpaced the consensus mark by 2.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Align Technology has a long-term estimated growth rate of 6.9%. ALGN’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 5.9%.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13.3%. ECL’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 1.7%.

Ecolab’s shares have rallied 33.8% against the industry’s 9.3% decline in the past year.

Boston Scientific reported first-quarter 2024 adjusted EPS of 56 cents, which beat the Zacks Consensus Estimate by 9.8%. Revenues of $3.86 billion surpassed the Zacks Consensus Estimate by 4.9%. It currently carries a Zacks Rank #2.

Boston Scientific has a long-term estimated growth rate of 12.5%. BSX’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 7.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Baxter International Inc. (BAX) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report