COTY Gears Up for Q3 Earnings: What Awaits the Stock?

Coty Inc. COTY is likely to register top-line growth when it reports third-quarter fiscal 2024 numbers on May 6. The Zacks Consensus Estimate for revenues is pegged at $1.4 billion, suggesting growth of 6.6% from the prior-year quarter’s reported figure.

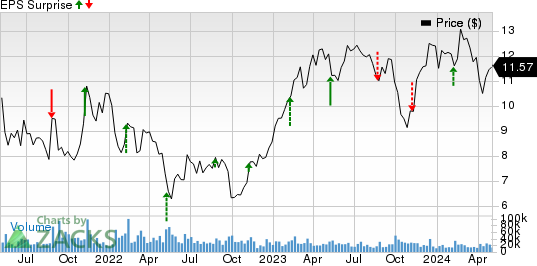

The company’s bottom line is likely to decline year over year in the fiscal third quarter. The consensus mark for quarterly earnings has remained unchanged in the past 30 days at 6 cents per share, projecting a plunge of 68.4% from the year-ago quarter’s reported figure. COTY has a trailing four-quarter earnings surprise of 115.3%, on average.

Coty Price and EPS Surprise

Coty price-eps-surprise | Coty Quote

Things To Note

Coty has been capitalizing on favorable market trends in the global beauty market. The company has been witnessing momentum in its core categories, driven by brand strength, product launches and expansion into untapped areas. Gains from Coty’s prudent partnerships are also contributing to the upside. The company’s focus on strategic pillars, like strengthening e-commerce and Direct-to-Consumer business, among others, bodes well.

All these upsides, along with management’s guidance for the second half of fiscal 2024, indicate favorable signals for fiscal third-quarter revenues. For the second half of fiscal 2024, Coty expects Like-for-like (LFL) revenue growth in the range of 6-8%.

Coty has been witnessing strength in the Prestige and Consumer Beauty businesses. Our model suggests revenue growth of 5.9% and 2.8%, respectively, for the Prestige and Consumer Beauty units in the fiscal third quarter.

However, Coty has been witnessing dynamic inflation and a supply chain environment. Our model suggests a 0.9% increase in the adjusted cost of sales for the third quarter of fiscal 2024, with SG&A expenses expected to rise 4.5% year over year. That being said, management’s focus on cost-saving efforts, evident from the All In to Win transformation program, is likely to have offered respite.

What the Zacks Model Unveils

Our proven model predicts an earnings beat for Coty this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Coty carries a Zacks Rank #3 and has an Earnings ESP of +4.23%.

Some More Stocks With the Favorable Combination

Here are three other companies worth considering, as our model shows that these also have the correct combination to beat on earnings this time:

Ollie's Bargain Outlet Holdings, Inc. OLLI currently has an Earnings ESP of +0.77% and a Zacks Rank of 3. The company is likely to register top- and bottom-line growth when it reports first-quarter fiscal 2024 numbers. The Zacks Consensus Estimate for Church & Dwight’s quarterly revenues is pegged at $503.8 million, indicating a rise of 9.7% from the figure reported in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ollie's Bargain’s quarterly earnings of 65 cents suggests a rise of 32.7% from the year-ago quarter’s levels. OLLI has a trailing four-quarter earnings surprise of 7.3%, on average.

Tyson Foods TSN currently has an Earnings ESP of +12.86% and a Zacks Rank of 3. The company is likely to register bottom-line growth when it reports second-quarter fiscal 2024 numbers. The Zacks Consensus Estimate for Tyson Foods’ quarterly earnings of 35 cents suggests an improvement from a loss of 4 cents reported in the year-ago quarter.

The Zacks Consensus Estimate for Tyson Foods’ quarterly revenues is pegged at $13.1 billion, flat year over year. TSN has a trailing four-quarter negative earnings surprise of 21.1%, on average.

International Flavors & Fragrances Inc. IFF currently has an Earnings ESP of +15.59% and a Zacks Rank of 3. The company is likely to register top- and bottom-line decline when it reports first-quarter 2024 numbers. The Zacks Consensus Estimate for International Flavors’ quarterly revenues is pegged at $2.8 billion, indicating a decline of 7.3% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for International Flavors’ quarterly earnings of 84 cents suggests a drop of 3.5% from the year-ago quarter’s levels. OLLI has a trailing four-quarter negative earnings surprise of 2.7%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Flavors & Fragrances Inc. (IFF) : Free Stock Analysis Report

Tyson Foods, Inc. (TSN) : Free Stock Analysis Report

Coty (COTY) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report