Traditional Fast Food Stocks Q4 Results: Benchmarking Restaurant Brands (NYSE:QSR)

Looking back on traditional fast food stocks' Q4 earnings, we examine this quarter's best and worst performers, including Restaurant Brands (NYSE:QSR) and its peers.

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

The 15 traditional fast food stocks we track reported a decent Q4; on average, revenues beat analyst consensus estimates by 0.6%. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, though the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, and traditional fast food stocks have held roughly steady amidst all this, with share prices up 0.7% on average since the previous earnings results.

Restaurant Brands (NYSE:QSR)

Formed through a strategic merger, Restaurant Brands International (NYSE:QSR) is a multinational corporation that owns three iconic fast-food chains: Burger King, Tim Hortons, and Popeyes.

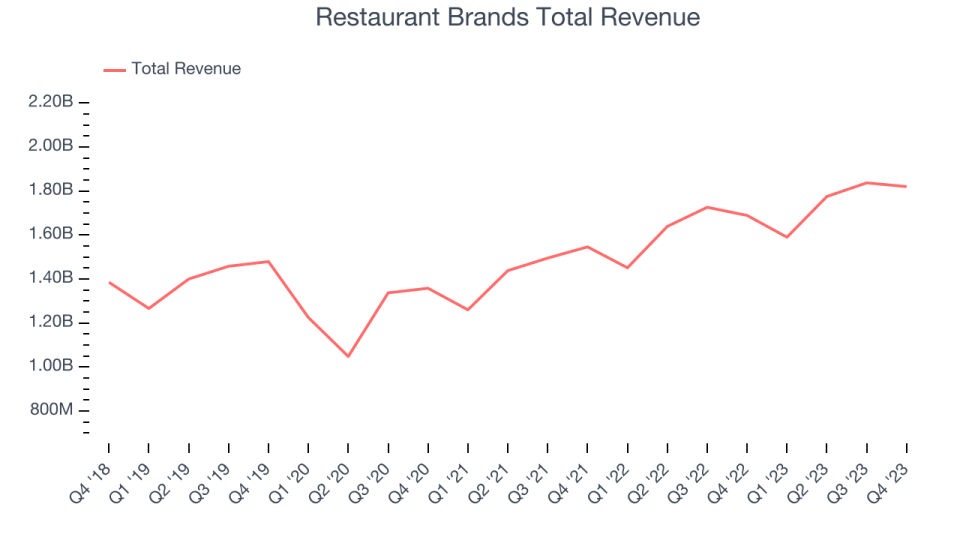

Restaurant Brands reported revenues of $1.82 billion, up 7.8% year on year, topping analyst expectations by 1%. It was a very strong quarter for the company, with an impressive beat of analysts' gross margin estimates and a decent beat of analysts' revenue estimates.

The stock is down 9.9% since the results and currently trades at $70.53.

Is now the time to buy Restaurant Brands? Access our full analysis of the earnings results here, it's free.

Best Q4: Yum China (NYSE:YUMC)

One of China’s largest restaurant companies, Yum China (NYSE:YUMC) is an independent entity spun off from Yum! Brands in 2016.

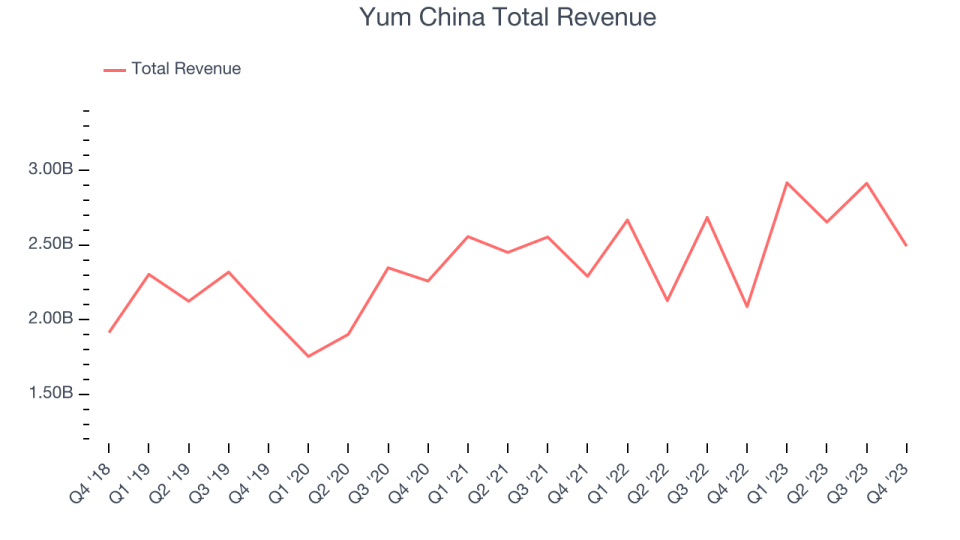

Yum China reported revenues of $2.49 billion, up 19.4% year on year, outperforming analyst expectations by 7%. It was a stunning quarter for the company, with revenue outperforming Wall Street's estimates, driven by better-than-expected same store sales and a higher number of locations. Profitability was solid, leading to an EPS beat. Looking ahead, the company reiterated that from 2024 to 2026, system sales and profit profit will grow at high-single-to-double-digit CAGRs, leading to a double-digit CAGR for EPS.

Yum China delivered the biggest analyst estimates beat among its peers. The stock is down 0.4% since the results and currently trades at $37.31.

Is now the time to buy Yum China? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Starbucks (NASDAQ:SBUX)

Started by three friends in Seattle’s historic Pike Place Market, Starbucks (NASDAQ:SBUX) is a globally-renowned coffeehouse chain that offers a wide selection of high-quality coffee, beverages, and food items.

Starbucks reported revenues of $9.43 billion, up 8.2% year on year, falling short of analyst expectations by 2.1%. It was a weak quarter for the company, with a miss of analysts' revenue and EPS estimates.

The stock is down 9.4% since the results and currently trades at $85.27.

Read our full analysis of Starbucks's results here.

Dutch Bros (NYSE:BROS)

Started in 1992 by two brothers as a single pushcart, Dutch Bros (NYSE:BROS) is a dynamic coffee chain that’s captured the hearts of coffee enthusiasts across the United States.

Dutch Bros reported revenues of $254.1 million, up 25.9% year on year, in line with analyst expectations. It was a slower quarter for the company, with full-year revenue guidance missing analysts' expectations.

Dutch Bros scored the fastest revenue growth among its peers. The stock is up 12.7% since the results and currently trades at $30.46.

Read our full, actionable report on Dutch Bros here, it's free.

Wendy's (NASDAQ:WEN)

Founded by Dave Thomas in 1969, Wendy’s (NASDAQ:WEN) is a renowned fast-food chain known for its fresh, never-frozen beef burgers, flavorful menu options, and commitment to quality.

Wendy's reported revenues of $540.7 million, flat year on year, falling short of analyst expectations by 1.1%. It was a slower quarter for the company, with underwhelming earnings guidance for the full year and a miss of analysts' revenue estimates.

The stock is down 3.6% since the results and currently trades at $18.59.

Read our full, actionable report on Wendy's here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.