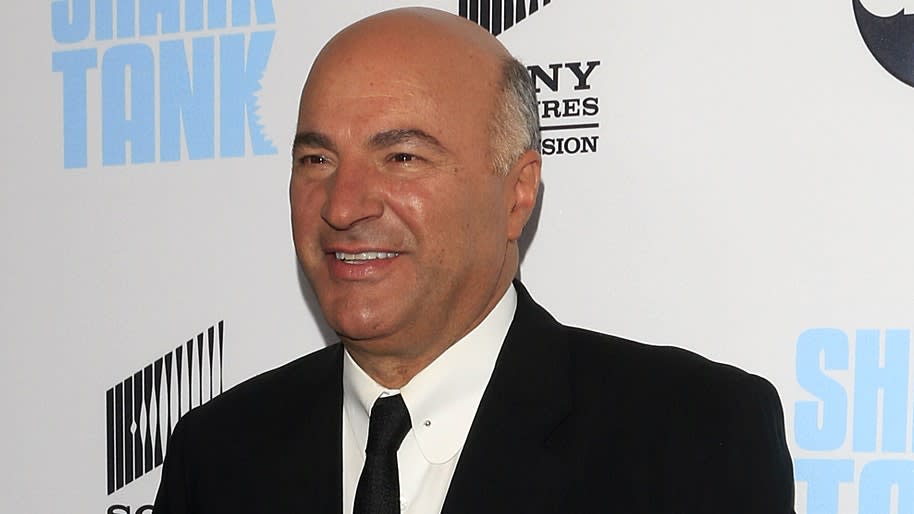

'Forget Shark Tank, Forget Bitcoin' Kevin O'Leary Says He Prefers Investments That Produce Cash Flow

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Are you looking to build a solid investment portfolio that can weather any market condition? Look no further than the wisdom of Kevin O’Leary, the renowned venture capitalist and Shark Tank star. In a recent LinkedIn post, O’Leary shared his investment strategy, emphasizing the importance of cash-flowing investments in a well-balanced portfolio.

“Forget Shark Tank, forget Bitcoin,” O’Leary stated. “Sure, I’ve got a 5% stake in Bitcoin and another 5% in gold, but the meat of my US portfolio? It’s in OUSA or OUSM.” These ETFs, managed by O’Shares, focus on quality dividends and positive cash flow from the S&P 500 and Russell 2000 indexes.

The ALPS O'Shares US Quality Dividend ETF (BATS:OUSA) and the ALPS O'Shares US Small-Cap Quality Dividend ETF (BATS:OUSM) are designed to provide investors with exposure to large-cap and small-cap dividend-paying companies that exhibit quality and low volatility. However, with yields of 1.69% and 1.5%, respectively, they may not be the most enticing income plays.

While high-risk, high-reward investments can be exciting, O’Leary’s approach highlights the significance of steady, reliable income as the foundation of a solid investment portfolio. If you’re looking to add yield-producing assets to your portfolio, consider these three compelling options:

Verizon Communication Inc. (NYSE:VZ)

With a dividend yield of 6.7% and a year-to-date price increase of 5.25%, Verizon is a strong contender for income investors. The telecom giant has been investing heavily in its 5G network, and the results are paying off. In Q1 2023, Verizon generated $2.7 billion in free cash flow, a $400 million year-over-year improvement. CEO Hans Vestberg reassured investors, stating, “Our dividend is healthy and secure.” Verizon has increased its dividend for 17 consecutive years, making it a reliable choice for income-seekers.

Cityfunds Yield Fund

Targeting an impressive 8% APY, the Cityfunds Yield fund offers investors stable cash flow backed by real estate assets. With quarterly distributions and a five-year term, this fund invests in a diversified pool of collateralized real estate loans, including home equity-backed notes and short-term mortgage notes. The fund’s manager-guaranteed base yield of 7% to 8% makes it an attractive option for those seeking passive income. You can learn more about the Cityfunds Yield fund here.

Fractional Rental Properties

Backed by Amazon founder Jeff Bezos, Arrived allows you to become a landlord with as little as $100. With over 580,000 registered investors and 370 funded properties, the platform has already paid out over $4.5 million in dividends, including over $1 million in Q1 2024 alone. Arrived purchases single-family rentals in up-and-coming neighborhoods and lets users buy shares of individual properties, earning passive income through rent and appreciation. You can view properties currently available to invest in here.

In an uncertain market, having a portion of your portfolio dedicated to cash-flowing investments can provide stability and help mitigate risk. As Kevin O’Leary’s investment strategy demonstrates, incorporating yield-producing assets like dividend stocks, ETFs or real estate can create a steady income stream and contribute to long-term financial security.

This article 'Forget Shark Tank, Forget Bitcoin' Kevin O'Leary Says He Prefers Investments That Produce Cash Flow originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.