Decoding Franklin Resources Inc (BEN): A Strategic SWOT Insight

Franklin Resources Inc (NYSE:BEN) showcases a robust balance sheet with a diverse asset management portfolio.

Recent acquisition of Putnam Investments signals strategic growth, yet operational expenses pose challenges.

Global presence and brand reputation stand as key strengths, while market volatility and regulatory changes loom as threats.

Opportunities for expansion in emerging markets contrast with competitive pressures in the asset management industry.

Franklin Resources Inc (NYSE:BEN), a global investment management firm, reported its latest financials in a 10-Q filing dated April 29, 2024. The company, known for its diverse range of investment services, has shown a notable increase in managed assets, now standing at $1.644 trillion, a significant rise from the previous year. This financial overview reveals a mixed picture: while operating revenues have increased to $2.152 billion from $1.927 billion in the same quarter of the previous year, operating income has seen a decrease to $129.3 million from $255.1 million. Net income attributable to Franklin Resources Inc has also dipped to $124.2 million from $194.2 million. These figures set the stage for a nuanced SWOT analysis, providing investors with a comprehensive understanding of the company's strategic position.

Strengths

Brand Power and Global Presence: Franklin Resources Inc's strong brand and global footprint are significant strengths. With over a third of its assets under management invested in global/international strategies and nearly 29% of managed assets sourced from clients outside the United States, the company's reputation as a global player is well-established. This international diversification not only mitigates geographic risks but also allows Franklin Resources to tap into growth markets worldwide. The recent acquisition of Putnam Investments further solidifies its market position, expanding its asset and client base.

Diverse Asset Management Portfolio: The company's asset management portfolio is well-diversified across equity (31%), fixed-income (35%), multi-asset/balanced (11%), alternatives (19%), and money market funds (4%). This diversification helps in risk management and appeals to a broad range of investors, from retail to institutional clients. The balance between retail investors and institutional accounts also provides a stable inflow of management fees, contributing to the company's financial resilience.

Weaknesses

Operational Cost Pressures: Despite revenue growth, Franklin Resources Inc faces increasing operational expenses, which have risen to $2.023 billion from $1.672 billion year-over-year for the quarter. The rise in compensation and benefits, sales, distribution, and marketing costs, among others, are squeezing operating margins. These cost pressures could impact profitability if not managed effectively, especially in a competitive asset management landscape where cost efficiency is key.

Declining Operating Income: The company's operating income has seen a notable decline, which may raise concerns about its operational efficiency and profitability in the short term. This decrease could be attributed to various factors, including increased competition, market volatility, or higher operational costs post-acquisition. It is crucial for Franklin Resources to address these issues to maintain investor confidence and financial health.

Opportunities

Expansion in Emerging Markets: Franklin Resources Inc has the opportunity to further expand its presence in emerging markets, which could provide new sources of revenue and diversification. With its global brand and expertise in various asset classes, the company is well-positioned to capitalize on the growing demand for investment services in these regions, where economic growth rates often outpace developed markets.

Technological Advancements: The investment industry is increasingly influenced by technology, from algorithmic trading to robo-advisors. Franklin Resources Inc can leverage its resources to invest in cutting-edge technology, enhancing its service offerings, operational efficiency, and customer experience. This could lead to improved asset acquisition and retention rates, as well as a competitive edge in a rapidly evolving market.

Threats

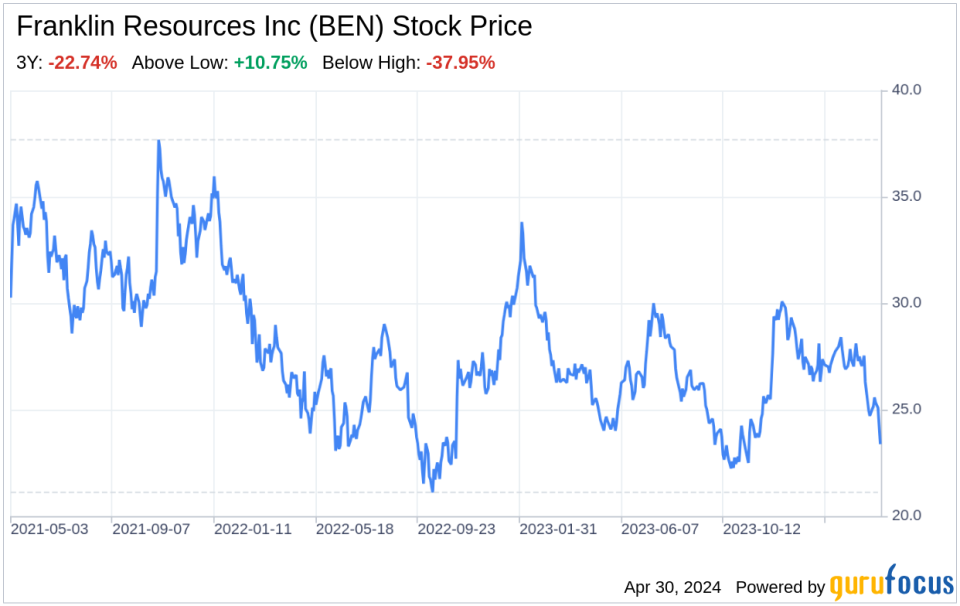

Market Volatility: As an investment management firm, Franklin Resources Inc is inherently exposed to market volatility. Fluctuations in global financial markets can significantly impact asset values and investor behavior, leading to potential reductions in assets under management and associated fees. The company must navigate these challenges carefully to sustain growth and profitability.

Regulatory Changes: The financial industry is subject to stringent and ever-evolving regulations. Changes in laws and regulations, both domestically and internationally, could impose additional compliance costs or limitations on Franklin Resources Inc's operations. Staying ahead of these changes and maintaining compliance is critical to avoid potential fines, reputational damage, or operational disruptions.

In conclusion, Franklin Resources Inc (NYSE:BEN) presents a robust profile with its strong brand, global presence, and diversified asset management portfolio. However, the company must navigate operational cost pressures and a decline in operating income. Opportunities for growth in emerging markets and through technological advancements are promising, but threats from market volatility and regulatory changes require vigilant management. The company's strategic moves, such as the acquisition of Putnam Investments, indicate a forward-looking approach that could help leverage strengths and opportunities while addressing weaknesses and threats.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.