Ken Fisher's Strategic Moves in Q1 2024: A Closer Look at ASML Holding NV

Insights into Fisher Investments' Latest 13F Filings

Ken Fisher (Trades, Portfolio), the CEO and CIO of Fisher Investments, is renowned for his contrarian investment approaches and deep market insights. With a legacy rooted in the teachings of his father, Philip A. Fisher, Ken has carved out a niche in the financial world through his unique analysis and successful market predictions. His investment philosophy centers on the belief that market prices are primarily driven by the supply and demand of securities, and that the key to outperformance lies in uncovering or interpreting information that is not widely recognized by the market. This approach has guided Fisher Investments to focus on rigorous research and analysis to stay ahead of market trends.

Summary of New Buys

Ken Fisher (Trades, Portfolio)'s portfolio saw the addition of 86 new stocks in the first quarter of 2024. Noteworthy new acquisitions include:

Nomura Holdings Inc (NYSE:NMR) with 8,478,338 shares, making up 0.03% of the portfolio and valued at $54.43 million.

Nutanix Inc (NASDAQ:NTNX), comprising 246,807 shares, which represent about 0.01% of the portfolio, totaling $15.23 million.

Aberdeen Total Dynamic Dividend Fund (NYSE:AOD) with 22,500 shares, valued at $186,530.

Key Position Increases

During the same period, Ken Fisher (Trades, Portfolio) increased his stakes in 396 stocks. Significant increases include:

Exxon Mobil Corp (NYSE:XOM), with an additional 13,250,383 shares, bringing the total to 26,431,190 shares. This adjustment represents a 100.53% increase in share count and a 0.72% impact on the current portfolio, valued at $3.07 billion.

Chevron Corp (NYSE:CVX), with an additional 9,262,121 shares, bringing the total to 17,859,776 shares. This represents a 107.73% increase in share count, valued at $2.82 billion.

Summary of Sold Out Positions

In Q1 2024, Ken Fisher (Trades, Portfolio) exited 102 positions. Notable exits include:

Veradigm Inc (MDRX), where all 2,264,275 shares were sold, impacting the portfolio by -0.01%.

Lineage Cell Therapeutics Inc (LCTX), with all 10,000 shares liquidated, causing a negligible impact on the portfolio.

Key Position Reductions

Significant reductions were made in 442 stocks, with notable decreases in:

ASML Holding NV (NASDAQ:ASML), reduced by 1,868,480 shares, resulting in a -37.61% decrease in shares and a -0.75% impact on the portfolio. The stock traded at an average price of $887.02 during the quarter and has seen a -3.48% return over the past three months and a 21.31% year-to-date return.

Salesforce Inc (NYSE:CRM), reduced by 4,064,284 shares, resulting in a -27.27% reduction in shares and a -0.56% impact on the portfolio. The stock traded at an average price of $288.53 during the quarter and has returned -5.48% over the past three months and 4.64% year-to-date.

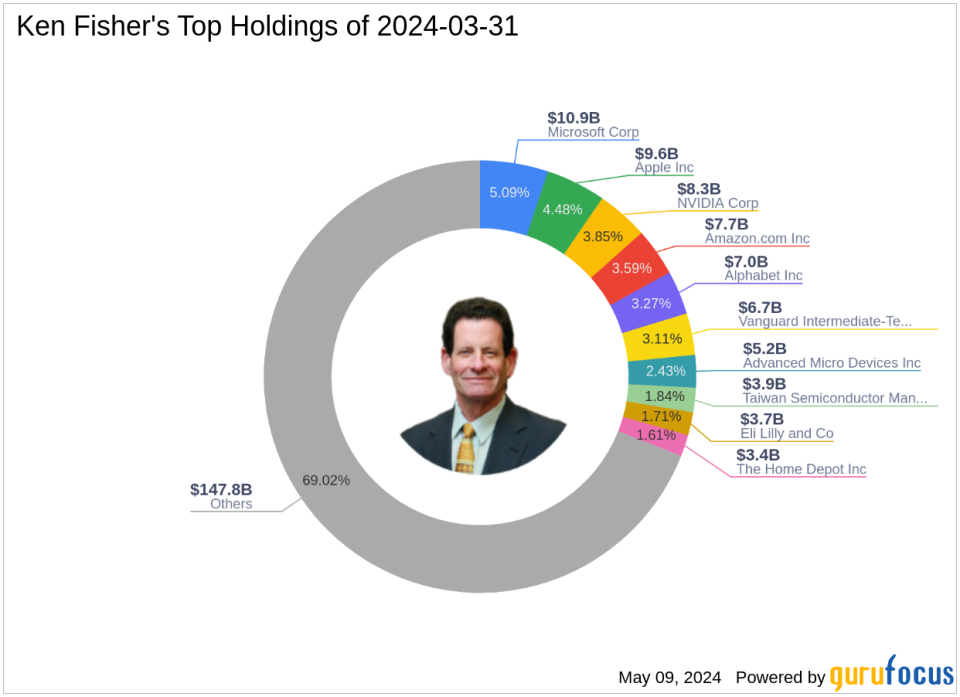

Portfolio Overview

As of the first quarter of 2024, Ken Fisher (Trades, Portfolio)'s portfolio included 966 stocks. The top holdings were:

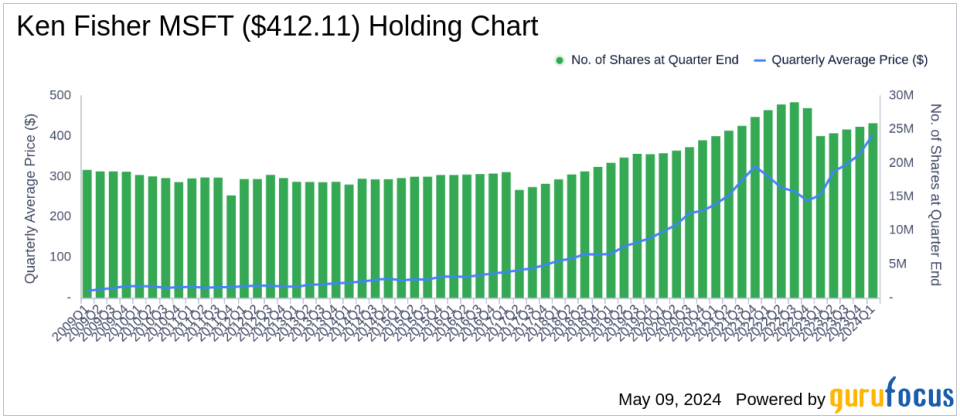

5.09% in Microsoft Corp (NASDAQ:MSFT)

4.48% in Apple Inc (NASDAQ:AAPL)

3.85% in NVIDIA Corp (NASDAQ:NVDA)

3.59% in Amazon.com Inc (NASDAQ:AMZN)

3.27% in Alphabet Inc (NASDAQ:GOOGL)

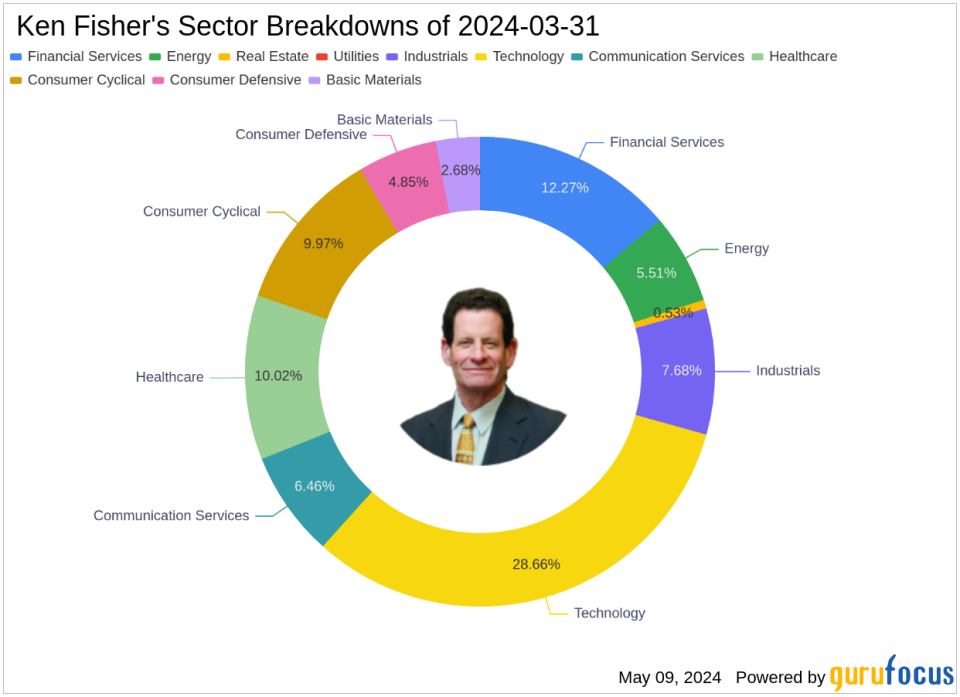

The portfolio is primarily concentrated across 10 industries, with significant investments in Technology, Financial Services, Healthcare, Consumer Cyclical, and others.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.