Federal Realty (FRT) Q1 FFO Miss Estimates, Revenues Rise Y/Y

Federal Realty Investment Trust’s FRT first-quarter 2024 funds from operations (FFO) per share of $1.64 missed the Zacks Consensus Estimate by a whisker. The figure marked a rise of 3.1% from the year-ago quarter’s tally of $1.59.

Results reflect a rise in revenues and healthy leasing activity that aided FRT’s first-quarter performance. However, lower occupancy levels affected the results to some extent.

Quarterly revenues of $291.3 million outpaced the consensus mark of $287.1 million and improved 6.7% from the year-ago quarter’s tally.

Per Donald C. Wood, Federal Realty's chief executive officer, "Federal Realty's strong start to 2024 is highlighted by our highest first-quarter leasing volume on record, surpassing 566,000 square feet of comparable retail space signed. In addition, we successfully executed leases for approximately 190,000 square feet of office space during the quarter at our premier mixed-use destinations."

Behind the Headlines

In terms of leasing, during the reported quarter, Federal Realty signed 111 leases for 587,329 square feet of retail space. On a comparable space basis, the company signed 104 leases for 566,865 square feet of space at an average rent of $36.39 per square foot. This denotes cash-basis rollover growth of 9% and 20% on a straight-line basis.

On the operational front, occupancy rates in the portfolio decreased 60 basis points (bps) year over year to 92% as of Mar 31, 2024. The portfolio was 94.3% leased as of the same date. Our estimate for the metric was 94.1%. Moreover, FRT’s residential properties were 96.3% leased as of the same date.

Sustained robust leasing activity for small shops resulted in a quarter-ending lease rate of 91.4%, marking a 140 bps rise year over year. This is the highest level of leasing rate since 2015.

Federal Realty exited the first quarter of 2024 with cash and cash equivalents of $95.9 million, down from $250.8 million recorded at the end of 2023.

Dividend

Concurrent with the first-quarter earnings release, Federal Realty announced a regular quarterly cash dividend of $1.09 per share, indicating an annual rate of $4.36 per share. The dividend will be paid out on Jul 15 to shareholders of record as of Jun 21, 2024.

Guidance

For 2024, FRT revised its guidance for FFO per share in the range of $6.67-$6.87 from the $6.65-$6.87 range guided earlier. The Zacks Consensus Estimate of $6.80 also stands within this range.

Federal Realty currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

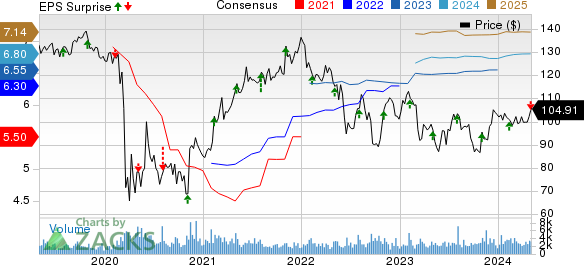

Federal Realty Investment Trust Price, Consensus and EPS Surprise

Federal Realty Investment Trust price-consensus-eps-surprise-chart | Federal Realty Investment Trust Quote

Performance of Other Retail REITs

The Macerich Company MAC reported an FFO per share, excluding financing expense in relation to Chandler Freehold, of 31 cents, which missed the Zacks Consensus Estimate of 39 cents. Moreover, the figure declined 22.5% from the year-ago quarter’s 40 cents.

The results reflected a year-over-year fall in quarterly revenues. MAC also experienced a decline in same-center net operating income, including lease termination income, from the prior-year period.

Kimco Realty Corp. KIM reported first-quarter 2024 FFO per share of 39 cents, which beat the Zacks Consensus Estimate of 38 cents. The figure was in line with the year-ago quarter’s tally.

Though KIM reported growth in revenues, a rise in interest expenses acted as a dampener.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kimco Realty Corporation (KIM) : Free Stock Analysis Report

Macerich Company (The) (MAC) : Free Stock Analysis Report

Federal Realty Investment Trust (FRT) : Free Stock Analysis Report