Bull Signal Flashing for Bank Stock

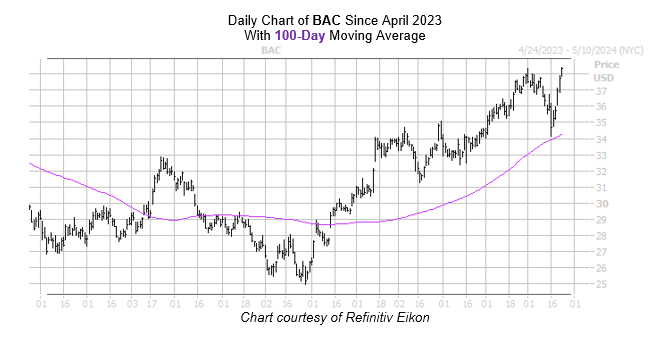

Major financial institution Bank of America Corp (NYSE:BAC) reported earnings last week and the shares bottomed out following the results, falling 3.5% the day of the quarterly report and testing their 100-day moving average. Fast forward to today, and BAC is up 1.6% to trade at $38.35, pacing for a sixth-straight win, filling that pos-earnings bear gap, and trading at its highest mark since November 2022. Better yet, a "buy" signal is flashing that could keep the wind at the equity's back.

BAC's Schaeffer's Volatility Index (SVI) of 23% is lower than 17% of the other readings from the past year, pointing to relatively attractive short-term premiums amid muted volatility expectations. The other four times over the past five years Bank of America stock has traded near new highs while its SVI ranked in the bottom 20th percentile of its annual range, the shares were higher each time, and averaged a one-month gain of 8.92%, per data from Schaeffer's Senior Quantitative Analyst Rocky White. A move of similar magnitude would put the security at $44.77 -- an area not seen since February 2022.

Puts are popular amongst short-term traders, and a shift in sentiment could help BAC move even higher. This is according to its Schaeffer's put/call open interest ratio (SOIR) of 1.58, which ranks in the 97th annual percentile.

Lastly, an elevated Schaeffer's Volatility Scorecard (SVS) reading of 77 suggests the security has tended to make outsized moves over the last 12 months, compared to what the option market has expected.