Exploring Argan Plus Two Additional High-Yield Dividend Stocks

Amidst a backdrop of fluctuating U.S. Treasury yields and cautious market sentiment ahead of Federal Reserve Chair Jerome Powell's testimony, investors are closely monitoring the impact on various asset classes. In such an environment, dividend stocks like Argan can attract attention for their potential to provide steady income streams regardless of broader market volatility.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

AGCO (NYSE:AGCO) | 5.55% | ★★★★★★ |

First Interstate BancSystem (NasdaqGS:FIBK) | 7.07% | ★★★★★★ |

Premier Financial (NasdaqGS:PFC) | 6.12% | ★★★★★★ |

Peoples Bancorp (NasdaqGS:PEBO) | 5.48% | ★★★★★★ |

Sierra Bancorp (NasdaqGS:BSRR) | 4.85% | ★★★★★★ |

Ennis (NYSE:EBF) | 5.05% | ★★★★★★ |

Dillard's (NYSE:DDS) | 5.32% | ★★★★★★ |

Burnham Holdings (OTCPK:BURC.A) | 6.94% | ★★★★★★ |

ALLETE (NYSE:ALE) | 4.89% | ★★★★★★ |

ONEOK (NYSE:OKE) | 5.10% | ★★★★★★ |

Click here to see the full list of 173 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

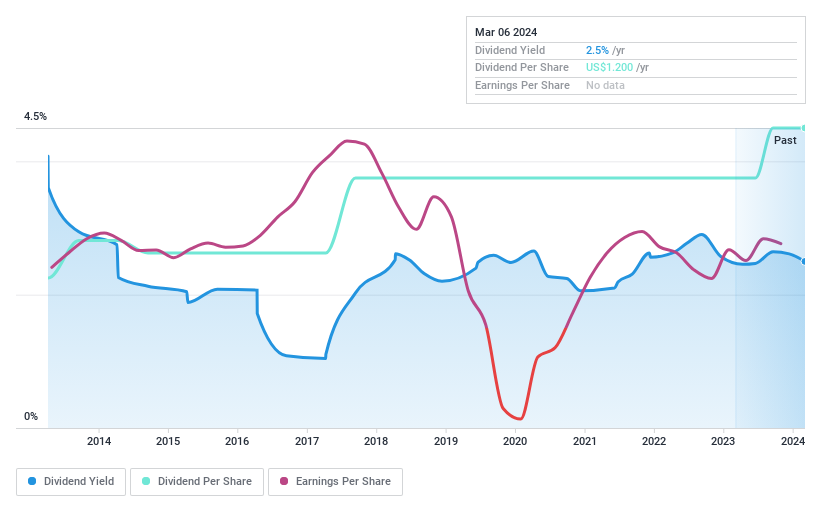

Argan (NYSE:AGX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Argan, Inc. is a company that offers a range of services including engineering, procurement, construction, and more to the power generation market, with a market capitalization of approximately $623.88 million.

Operations: Argan, Inc. generates its revenues primarily from Power Services at $386.90 million, followed by Industrial Services with $126.61 million, and Telecom Services contributing $14.05 million.

Dividend Yield: 2.5%

Argan, Inc. sustains a secure dividend with a payout ratio of 41.5% and cash payout ratio at 12.1%, indicating earnings and cash flows comfortably cover distributions. Despite trading below fair value by 24.9%, its yield at 2.5% is modest relative to leading US market payers. The firm's commitment to dividends is evident with consistent growth over the past decade, reinforced by recent affirmations of quarterly payments, ensuring reliability for income-focused investors amidst negligible insider selling in the last quarter.

Click to explore a detailed breakdown of our findings in Argan's dividend report.

The valuation report we've compiled suggests that Argan's current price could be quite moderate.

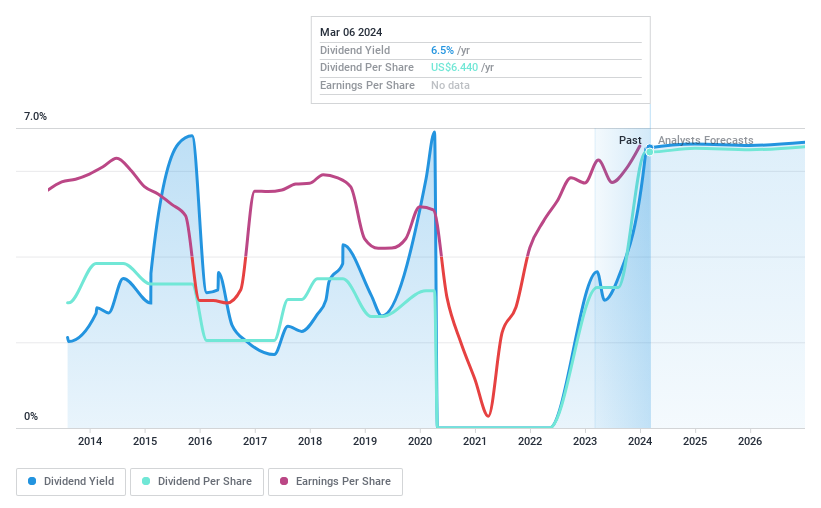

Copa Holdings (NYSE:CPA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Copa Holdings, S.A. is a leading Latin American company that operates passenger and cargo airline services with a market capitalization of approximately $4.15 billion.

Operations: Copa Holdings generates its revenue primarily from air transportation services, amounting to approximately $3.46 billion.

Dividend Yield: 6.5%

Copa Holdings boasts a dividend yield higher than the US market average at 6.54%, underpinned by a solid earnings growth of 33.5% annually over five years, suggesting potential for continued payouts. The dividends, with recent increases to US$1.61 per share, are comfortably supported by both earnings and cash flows, with payout ratios below 30%. However, investors should note the history of dividend volatility and a recent dip in load factors which could signal operational headwinds.

Click here to discover the nuances of Copa Holdings with our detailed analytical dividend report.

Our valuation report here indicates Copa Holdings may be undervalued.

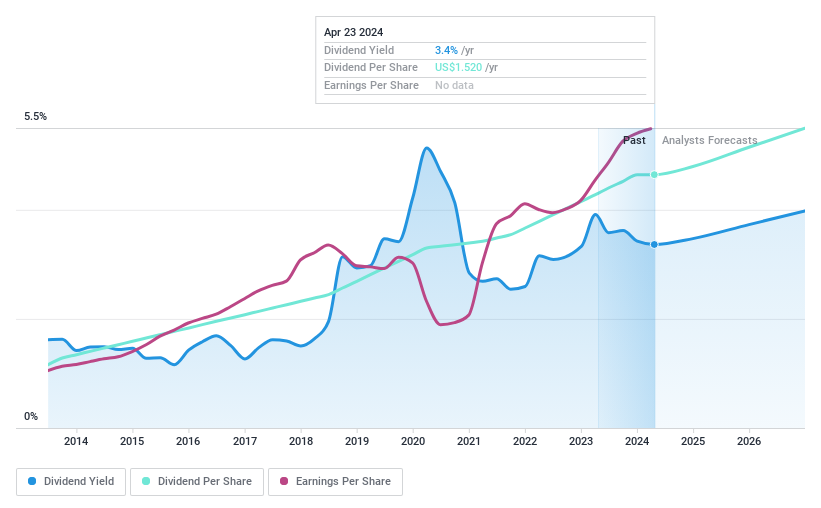

Bank OZK (NasdaqGS:OZK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank OZK, operating within the United States, offers a range of retail and commercial banking services to individuals and businesses, with a market capitalization of approximately $5.03 billion.

Operations: Bank OZK generates its revenue primarily through its community banking segment, which amassed $1.37 billion in the reported period.

Dividend Yield: 3.5%

Bank OZK's recent earnings report showed a year-over-year increase with net income rising to US$175.13 million in Q4 2023, and full-year net interest income up at US$1.44 billion. The bank has demonstrated consistent dividend growth, recently raising its common stock dividend to US$0.38 per share, reflecting a modest 2.70% hike from the previous quarter. Despite dividends being well-covered by earnings with a low payout ratio of 24.1%, the current yield of 3.46% trails behind the top quartile of US dividend payers, potentially limiting appeal for yield-seeking investors. No substantial insider selling was reported over the past quarter, indicating possible confidence in Bank OZK's stability among insiders; however, an uptick in net charge-offs could warrant caution for risk-averse investors seeking dependable returns from dividends stocks.

Navigate through the intricacies of Bank OZK with our comprehensive dividend report here.

Upon reviewing our latest valuation report, Bank OZK's share price might be too pessimistic.

Summing It All Up

Click through to start exploring the rest of the 170 Top Dividend Stocks now.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion.

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com