3 Vanguard ETFs to Buy If You're Looking for Reliable Passive Income

Vanguard exchange-traded funds (ETFs) are excellent ways to get low-cost exposure to a variety of stocks. And while investors may be familiar with one of the more well-known Vanguard funds like the Vanguard S&P 500 ETF, Vanguard Growth ETF, or the Vanguard Value ETF, there may be even better funds out there for generating reliable passive income

With expense ratios of 0.10% or less, here's why the Vanguard High-Dividend Yield ETF (NYSEMKT: VYM), Vanguard Dividend Appreciation ETF (NYSEMKT: VIG), and the Vanguard Utilities ETF (NYSEMKT: VPU) are all great choices for generating dividend income.

1. Vanguard High-Dividend Yield ETF

When investors think of high-yield dividend stocks, companies with 4%, 5%, or maybe even 6% dividend yields may come to mind. And while there are plenty of stocks out there with those kinds of yields, the Vanguard High-Dividend Yield ETF balances quality with yield by focusing on companies where dividends are a core part of the capital return program. The emphasis on quality is one of the reasons why the fund yields 2.8% -- which may be less than what you may expect from a high-yield fund.

Procter & Gamble (NYSE: PG), which is the fund's fifth-largest holding, is a great example of the caliber of company you'll find in this ETF. P&G yields 2.5%, which is decent but not great. But the company is as reliable as it gets, with 68 consecutive years of dividend raises and a massive capital return program that features buybacks and dividends.

ExxonMobil and Chevron are also top 10 holdings in the ETF. So are big banks JPMorgan Chase and Bank of America. Despite having a mere 1.4% yield, Walmart is the 11th largest holding, and is a good example of why yield isn't everything. Walmart is a Dividend King with over 50 consecutive years of dividend raises. Its low 1.4% yield is mainly a result of the stock's strong performance and not a lack of commitment to the dividend.

Vanguard High-Dividend Yield ETF gives investors a yield that is more than double the yield of the Vanguard S&P 500 ETF, while still focusing on quality.

2. Vanguard Dividend Appreciation ETF

The Vanguard Dividend Appreciation ETF is basically a more extreme example of the Vanguard High-Dividend Yield ETF. It focuses even more on quality than yield by including growth stocks you wouldn't find in the High-Dividend Yield ETF.

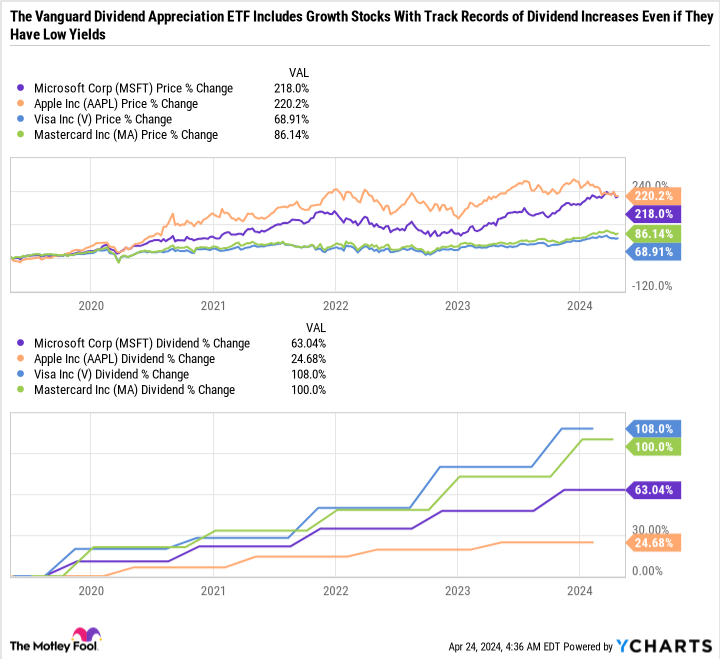

Notable examples are Microsoft (NASDAQ: MSFT) and Apple (NASDAQ: AAPL), the two largest holdings in the Dividend Appreciation ETF -- making up a combined 7.7% weighting. Visa (NYSE: V) and Mastercard (NYSE: MA) are also top 10 holdings.

The fund focuses on companies with track records of dividend increases, where yield is an afterthought. Growth stocks drag the fund's yield down to just 1.8%, but again, the focus is more on companies that are committed to raising their dividends. In this vein, the fund doesn't punish a company with a low yield due to an outperforming stock price.

For example, Microsoft, Apple, Visa, and Mastercard have all put up solid returns over the last five years, but they have also rapidly increased their dividends in a relatively short amount of time (except Apple, which spends way more on buybacks than dividends). By comparison, low-growth companies that focus on dividends and buybacks rather than reinvest in their businesses often underperform the market.

Even though all four stocks yield between 0.5% and 0.7%, they are still top holdings in the fund because they are committed to their dividends. In fact, Microsoft and Apple pay more dividends than any other U.S.-based company, but they are so massive that it would take a lot to pay a compelling yield. With a market capitalization of just over $3 trillion, Microsoft would have to pay over $90 billion per year in dividends just to have a 3% yield -- roughly the value of companies like Palo Alto Networks, CVS Health, or Dell Technologies.

The Vanguard Dividend Appreciation ETF is my personal favorite ETF on this list because it focuses on the most important quality of a dividend-paying company -- growing the payout over time. There are plenty of companies with high yields because their stock prices have underperformed the market. But a high yield means little if the capital losses outweigh the payout or the dividend is unsustainable and the company cuts it.

3. Vanguard Utilities ETF

Utility companies are excellent passive income investments because they tend to generate consistent cash flows no matter what the economy is doing. The Vanguard Utilities ETF has a yield of 3.3%, making this ETF a good choice for investors who want to generate a sizable amount of passive income or supplement income in retirement.

The Vanguard Utilities ETF is a straightforward product that mirrors the performance of the utility sector. The fund is a good fit for value investors as well, since it sports a price-to-earnings (P/E) ratio of 20.5 -- which is lower than the 24.9 for the Dividend Appreciation ETF and 25.3 for the Vanguard S&P 500 ETF.

But despite being more on the value side of the market, utility stocks can still be more expensive than sectors like energy, materials, and many industrial and financial stocks. Therefore, it may surprise you that the Vanguard High-Yield ETF has an even lower 16.1 P/E ratio. Still, utility stocks are a great choice if you're looking for passive income and a sector that has historically been defensive in nature and "safe" during recessions.

Power your passive income with an ETF that's right for you

The Vanguard High-Dividend Yield ETF, Vanguard Dividend Appreciation ETF, and the Vanguard Utilities ETF showcase the different ways you can invest in dividend stocks. The best pick for you will depend on your risk tolerance and the growth/value balance you may be looking for.

Especially for risk-tolerant investors with long time horizons, the key is not to get too caught up in what a stock yields today and focus more on finding a company with a strong investment thesis and runway for growing earnings and dividends for years, if not decades, to come. That's why the Vanguard Dividend Appreciation ETF is my favorite choice on this list, but the other two funds are also solid picks.

Should you invest $1,000 in Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF right now?

Before you buy stock in Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $508,797!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 30, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Bank of America, Chevron, JPMorgan Chase, Mastercard, Microsoft, Palo Alto Networks, Vanguard Index Funds-Vanguard Growth ETF, Vanguard Index Funds-Vanguard Value ETF, Vanguard S&P 500 ETF, Vanguard Specialized Funds-Vanguard Dividend Appreciation ETF, Vanguard Whitehall Funds-Vanguard High Dividend Yield ETF, Visa, and Walmart. The Motley Fool recommends CVS Health and recommends the following options: long January 2025 $370 calls on Mastercard, long January 2026 $395 calls on Microsoft, short January 2025 $380 calls on Mastercard, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

3 Vanguard ETFs to Buy If You're Looking for Reliable Passive Income was originally published by The Motley Fool